Starting from the 1st of January 2020, the new amendments of the VAT Directive 2006/112/CCE regarding the taxation of chain transaction and the proof of intracommunity supply of goods will enter into force.

Chain transactions

The Directive (EU) 2018/1910 from 4th of December 2018 amended the Directive 2006/112/CE (VAT Directive) by introducing art. 36 a. For the first time, it regulates the chain transactions, meaning, the successive supplies of the same good which are subject to a single intra-Community transport between two Member States.

The Court of Justice of the European Union has ruled in the case Euro Tyre Holding, C-430/09, that in the case of two successive supplies of the same good, between taxable persons acting as such, subject to a single intra-Community transport, this transport can only be attributed to one of the supplies. Therefore, it must be established at a unitary level which of the transactions is to be considered as exempted from VAT.

The new rule stated that the transport is to be ascribed to the first supply made by the initial seller to the intermediary operator (the buyer-reseller), in order for this first supply to be considered as exempted from VAT.

However, there is a possibility to derogate from the general rule. The transport will be ascribed to the supply of goods made by the intermediary operator to the final beneficiary, if this intermediary operator has transmitted to his supplier a valid VAT identification number issued by the Member State from which the goods are dispatched or transported.

When applying art. 36 a, it is of utter importance to determine the intermediary operator. This is the supplier in the chain other than the first supplier, who dispatches or transports the goods, himself or by a third party on his behalf. Neither the first, nor the last person in the chain cannot be considered to be intermediary operators.

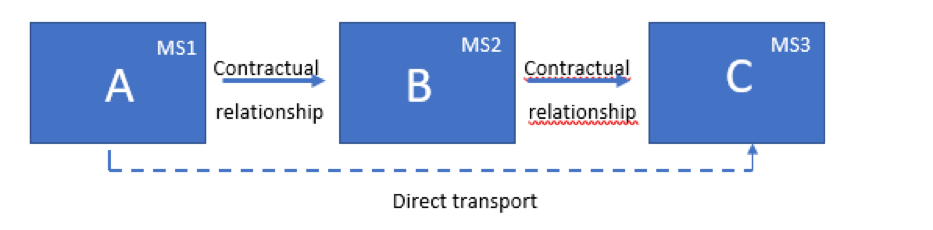

In this example of successive supplies of goods, from the initial seller A to the intermediary operator B and then from B to the final buyer C, with a single transport operation, directly from A to C, the transport will be attributed to the first supply of goods from A to B. Therefore, we will have a single exempt intra-Community supply of goods – from A to B.

When it comes to the complex operations, with more than 3 parties involved and more than one transport operations, art. 36 a must be applied individually, to every chain operation present in the series of transactions.

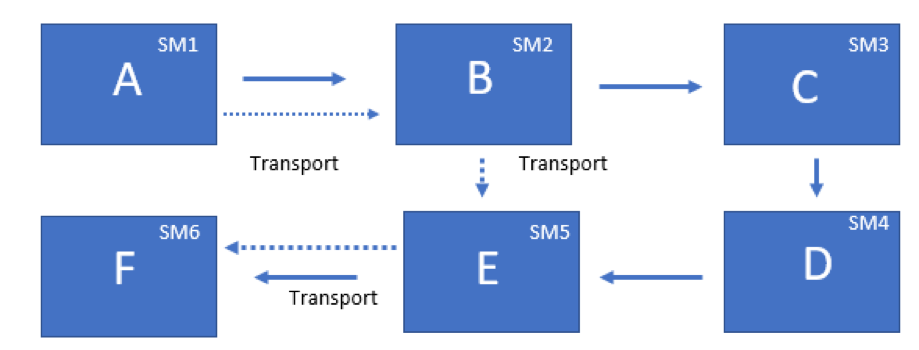

Analysing this example, it can be noted that we have a single chain operation, between B-C-D-E. This is the single situation when the goods are subject to a series of successive supplies (from the contractual point of view), but they are subject to a single direct transport, from B to E. The supplies from A to B and from E to F are classic intra-Community supplies of goods, as each of them has a corresponding transport operation.

Analysing this example, it can be noted that we have a single chain operation, between B-C-D-E. This is the single situation when the goods are subject to a series of successive supplies (from the contractual point of view), but they are subject to a single direct transport, from B to E. The supplies from A to B and from E to F are classic intra-Community supplies of goods, as each of them has a corresponding transport operation.

Just in the chain of transactions B-C-D-E we can apply the rule from art. 36 a. In order to do so, one must first determine who is the intermediary operator, based on the person who dispatches or transports the goods, by himself or by a third party on his behalf.

If the transport is realized by the first supplier in the chain – B, we find ourselves in a situation that exceeds the scope of application of art. 36 a, as B cannot be considered an intermediary operator within the meaning of art. 36 a paragraph 3. Therefore, we will apply the rules form art. 138 of the VAT Directive, as we are in the presence of a intra-Community supply of goods between B and C, which is exempt from VAT in Member State 2 and an intra-community acquisition made by C in MS5. The supplies from C-D and D-E are domestic supplies in the Member State 5.

If the transport is organised by the last buyer in the chain – E, who cannot be an intermediary operator, we will have a classic intra-Community supply of goods between D and E based on art. 138 of the VAT Directive, exempt from VAT for D in the Member State 2 and a intra-Community acquisition, taxable for E in the Member State 5. The supplies between B-C and C-D will be treated as domestic supplies in the Member State 2.

If C or D will organise the transport, both of the will fulfil the conditions to be deemed intermediary operator, therefore art. 36 a will become applicable. In the case of C, the intra-Community supply of goods will be that between B and C, and for D that between C and D. The rest of the supplies will be domestic supplies.

The proof of the intra-Community supply

Another amendment targets the proof of the intra-Community supply. A presumption that the goods have been transported from one Member State to another Member State has been put into place. This was introduced by the Council Implementing Regulation (EU) 2018/1912 of 4th December 2018 amending Implementing Regulation (EU) no. 282/2011.

Article 45 a states that if the seller declares that the goods have been transported to another Member State and is in possession of the documents mention below, it is automatically presumed that the goods have been dispatched to another Member State and implicitly that there is an intra-Community supply of goods, exempt from VAT based on art. 138 of the VAT Directive.

However, the presumption does not operate to the contrary. Therefore, if the conditions of art. 45 a are not met, it cannot be considered ab ignition and automatically that the exemption for intra-Community goods is not applicable. The sender must prove that the conditions set in art. 138 of the VAT Directive are met.

This is a relative presumption, that can be overturned, based on objective elements by the tax authority, which has the burden of proof.

In order to apply the exemption set in art. 138 of the VAT Directive, it is presumed that the goods have been dispatched or transported from one Member State to another Member State, in any of the following cases:

- The vendor indicates that the goods have been dispatched or transported by him or by a third party on his behalf and the vendor is in possession of at least two non-contradictory documents referring to the dispatch or transport of goods (a signed CMR document or note, a bill of landing, an airfreight invoice or an invoice from the carrier of goods), issued by two different parties that are independent of each other, of the vendor and of the acquirer

Or

The vendor is in possession of a single transport document of the aforementioned ones, together with a single non-contradictory proof that confirms the dispatch or transport, issued by two different parties that are independent of each other, of the vendor and of the acquirer, from the following:

- an insurance policy with regard to the dispatch or transport of the goods, or bank documents proving payment for the dispatch or transport of the goods;

- an official documents issued by a public authority, such as a notary, confirming the arrival of the goods in the Member State of destination;

- a receipt issued by a warehouse keeper in the Member State of destination, confirming the storage of goods in that Member State.

- The vendor is in possession of the following:

- A written statement from the acquirer, stating that the goods have been dispatched or transported by the acquirer, or by a third party on behalf of the acquirer, and identifying the Member State of destination of the goods; that written statement shall state: the date of issue; the name and address of the acquirer; the quantity and nature of the goods; the date and place of the arrival of the goods; in the case of the supply of means of transport, the identification number of the means of transport; and the identification of the individual accepting the goods on behalf of the acquirer (the acquirer will transmit the statement until the 10th of the month following the supply)

and

- At lest two non-contradictory documents referring to the dispatch or transport of the goods a signed CMR document or note, a bill of landing, an airfreight invoice or an invoice from the carrier of goods), issued by two different parties that are independent of each other, of the vendor and of the acquirer

or

The vendor is in possession of a single transport document of the aforementioned ones, together with a single non-contradictory proof that confirms the dispatch or transport, issued by two different parties that are independent of each other, of the vendor and of the acquirer, from the following:

- an insurance policy with regard to the dispatch or transport of the goods, or bank documents proving payment for the dispatch or transport of the goods;

- an official documents issued by a public authority, such as a notary, confirming the arrival of the goods in the Member State of destination;

- a receipt issued by a warehouse keeper in the Member State of destination, confirming

Concluding, it can be noted that the new legislative changes at the European level tend to bring clarity and certainty regarding the intra-Community supply of goods and implicitly the applicability of the VAT exemption, simplifying the proof due to problems arising in practice.

For more details about the legislative changes presented here you can contact the lawyers of Costaș, Negru & Asociații using the contact details provided on our website, https://www.costas-negru.ro.

This presentation was prepared for our website by Ms. Alexandra Tomuța.