Gambling. Televised bingo. Gambling taxes. (Non) Tax advertising

The solutions in legal matters are sometimes like the results of any gambling: at the hand of chance. For the Costaș, Negru & Asociaţii lawyers’ civil partnership any solution that [...]

Read More

Services provided by nannies. Financial Aid

In spite of recent events, good news for parents and legal guardians have emerged: Law no. 35/2020 on granting financial assistance to families for paying the services offered by nannies [...]

Read More

Can lawyers benefit from the support measures provided by G.E.O. no. 30/2020?

At the request of some fellow lawyers, I decided to write a few lines about the possibility of lawyers to benefit from the support measures created by the Government, included [...]

Read More

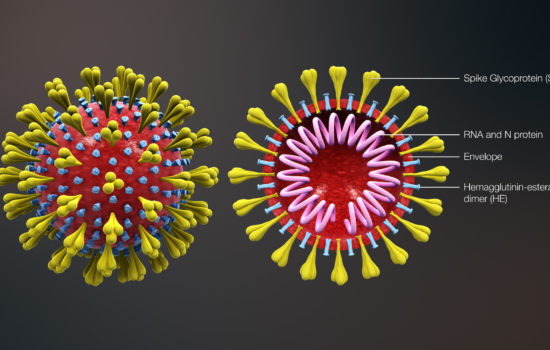

Covid 19. Support Measures in the Context of the Sanitary Crisis. New Clarifications

In the context of the economic developments under the sanitary crisis, the Government has recently offered, by Emergency Ordinance no. 32/2020 and Emergency Ordinance no. 33/2020 (both published in the [...]

Read More

Emergency certificates. Reloaded

On 25.03.2020 was published the Order of the Minister of Economy, Energy and Business Environment no. 791/2020 regarding the granting of emergency situations certificates to the economic operators whose activity [...]

Read More

Pandemic O.U.G no. 30/2020. The main economic measures in Romania

In the context of the SARS-CoV-2 coronavirus pandemic, through O.U.G. no. 30/2020, published in the Official Gazette no. 231 of March 21, 2020, the Government has taken some economic measures [...]

Read More

Cancelled Wizz Air Flight. Pecuniary Damages

Cases concerning pecuniary damages related to cancelled or delayed flights, under Regulation (EC) No. 261/2004, are, in a way, our trademark. We are pleased to say that today, the 30th [...]

Read More

Certificates attesting a state of emergency

On 16.03.2020, the President of Romania instituted the state of emergency by Decree, for a period of 30 days. Among the measures established by the decree are the provision in [...]

Read More

Environmental Taxes. Ecotax Annulled by Bucharest Court of Appeal

Our tax practice in the matter of environmental taxation has been enriched with a new judicial decision: civil judgment no. 146/19.01.2018 of the Bucharest’s Court of Appeal, Section VIII Administrative [...]

Read More

Banks. Closing payment Accounts. Suspicious actions. Possible fraud

In the analysis of this article, the law firm Costaş, Negru & Associates calls into question several issues which are topical and in connection with the closure of bank accounts [...]

Read More

Search

Recent Post

Archive

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||