POSTS BY : Cosmin Costaș

Services provided by nannies. Financial Aid

In spite of recent events, good news for parents and legal guardians have emerged: Law no. 35/2020 on granting financial assistance to families for paying the services offered by nannies [...]

Read More

Can lawyers benefit from the support measures provided by G.E.O. no. 30/2020?

At the request of some fellow lawyers, I decided to write a few lines about the possibility of lawyers to benefit from the support measures created by the Government, included [...]

Read More

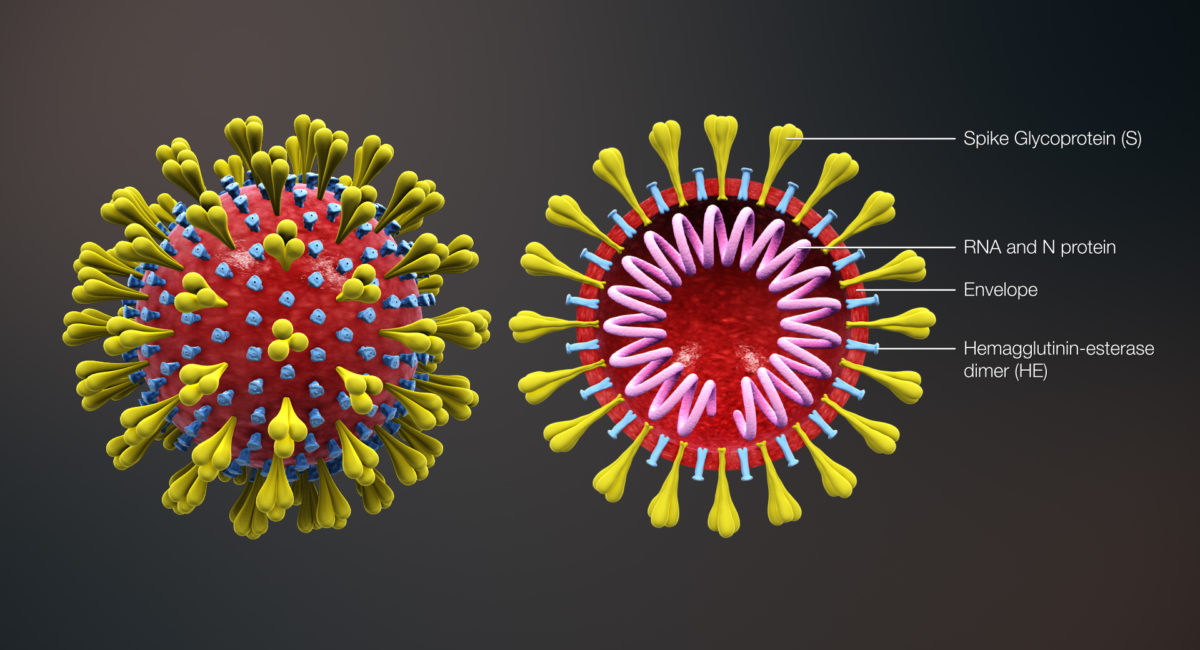

Covid 19. Support Measures in the Context of the Sanitary Crisis. New Clarifications

In the context of the economic developments under the sanitary crisis, the Government has recently offered, by Emergency Ordinance no. 32/2020 and Emergency Ordinance no. 33/2020 (both published in the [...]

Read More

Emergency certificates. Reloaded

On 25.03.2020 was published the Order of the Minister of Economy, Energy and Business Environment no. 791/2020 regarding the granting of emergency situations certificates to the economic operators whose activity [...]

Read More

Pandemic O.U.G no. 30/2020. The main economic measures in Romania

In the context of the SARS-CoV-2 coronavirus pandemic, through O.U.G. no. 30/2020, published in the Official Gazette no. 231 of March 21, 2020, the Government has taken some economic measures [...]

Read More

Cancelled Wizz Air Flight. Pecuniary Damages

Cases concerning pecuniary damages related to cancelled or delayed flights, under Regulation (EC) No. 261/2004, are, in a way, our trademark. We are pleased to say that today, the 30th [...]

Read More

Certificates attesting a state of emergency

On 16.03.2020, the President of Romania instituted the state of emergency by Decree, for a period of 30 days. Among the measures established by the decree are the provision in [...]

Read More

Environmental Taxes. Ecotax Annulled by Bucharest Court of Appeal

Our tax practice in the matter of environmental taxation has been enriched with a new judicial decision: civil judgment no. 146/19.01.2018 of the Bucharest’s Court of Appeal, Section VIII Administrative [...]

Read More

Banks. Closing payment Accounts. Suspicious actions. Possible fraud

In the analysis of this article, the law firm Costaş, Negru & Associates calls into question several issues which are topical and in connection with the closure of bank accounts [...]

Read More

Suspension Based on Article 15, after the Delivery of the First Instance Court Judgement

We open 2018 with an innovative legal solution achieved by the Costaș, Negru & Asociații lawyers: the suspension of administrative-fiscal decision under article 15 of Law no. 554/2004, after the [...]

Read More

Search

Recent Post

Recent Posts

- The VAT Tax Burden for Compensation Paid upon Expropriation

- Tax Evasion. HP Decision no. 430/2025. Sanction for failure to prepare the expert report

- RO e-Transport. Favourable decisions regarding the confiscation as a complementary sanction

- Costaș, Negru & Asociații successfully represented Banca Transilvania for the cancellation of the tax obligations of the former Bancpost

- Recovery of State Aid. Cancellation of a Significant Proportion of the Recovery Decision

Archives

- January 2026

- December 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- January 2025

- December 2024

- November 2024

- September 2024

- August 2024

- July 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- February 2021

- January 2021

- November 2020

- October 2020

- May 2020

- April 2020

- March 2020

- February 2020

- December 2019

- October 2019

- June 2019

- October 2018

- August 2018

Categories